The diamond industry has a complicated relationship with fluorescence.

Historically, both the trade and consumers saw value in a diamond that has fluorescence under ultraviolet light. The perception was that it added to the color of the diamond while also providing various niche marketing opportunities. Take the ’80s disco era, when neon was in and a glow-in-the-dark diamond might have been cool.

But the positive view of fluorescence has changed over time — at least, from the trade’s perspective. Various periods of oversupply, and one or two scandals related to the subject, led the trade to discount diamonds with varying degrees of fluorescence. We explore this issue in the November issue of Rapaport Research Report and present our updated guidelines to what those discounts are. The higher the color, the more fluorescence negatively affects price.

The discounts are puzzling. The Gemological Institute of America (GIA) published a comprehensive paper on fluorescence in 1997, in which it challenged the notion that this trait had a negative impact on higher color diamonds. If anything, the GIA concluded, fluorescence adds to lower colors, and it does not affect a diamond’s transparency.

Most importantly, the GIA found that the jewelry-buying public saw no difference between diamonds with fluorescence and those without. It wasn’t an issue for the consumer back then, and it isn’t today, according to most of the diamond professionals we consulted for the report.

If that is true, the trade is missing out on an opportunity. The biggest challenge facing the industry is figuring out how to broaden demand, which has narrowed over the past decade as buyers have become more specific in their requirements. As a result, there is an oversupply of diamonds that are difficult to sell. In many cases, it’s because they are fluorescent goods.

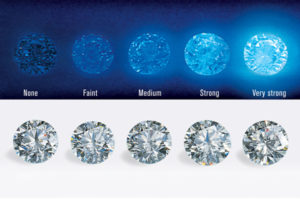

We’re seeing a recovery in demand for stones with faint or no fluorescence, and continued weakness among diamonds in the medium, strong and very strong categories. That’s difficult to understand if the consumer isn’t too bothered about the issue.

And therein lies the opportunity: Savvy diamantaires and jewelers are buying fluorescent goods and marketing them as a specialized product. Some big sellers — most notably Alrosa — have a lot of fluorescence in their production and are trying to create a category for those stones. Considering that the industry needs an avenue for offloading its fluorescent diamonds, it should be encouraging initiatives like these.

To download the full report as a subscriber to the Rapaport Research Report, or to subscribe, click here.

Image: The GIA’s fluorescence scale, showing diamonds illuminated in natural light

and under a UV light. (GIA)

Hurrah! Finally I got a blog from where I be able to in fact

get useful information concerning my study and knowledge. http://uricasino114.com